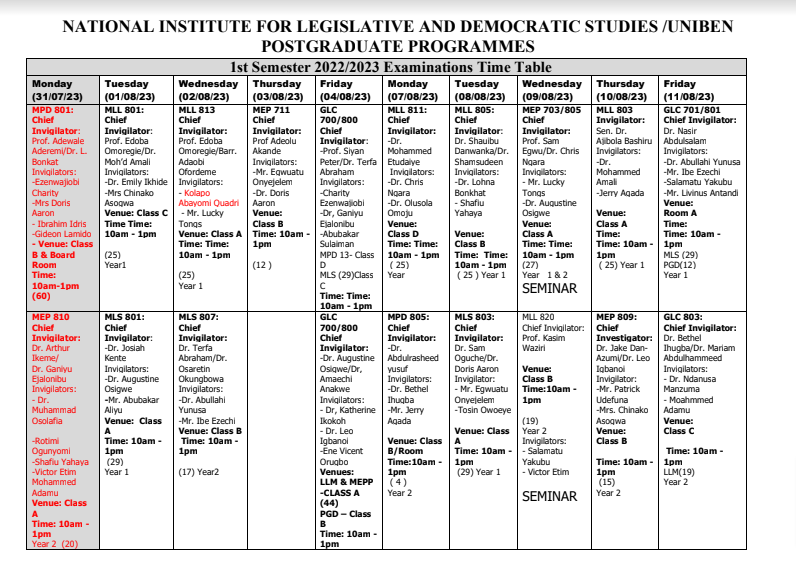

National Assembly Moves to Establish Legal Framework for Artificial Intelligence in Nigeria.

Speaker, House of Representatives, Rt. Hon. Tajudeen Abbas, has assured that the 10th National Assembly will establish a legal framework to govern the adoption of Artificial Intelligence, AI, in the […]